Get Started

API Endpoint: https://pg.bnypay.in

The BNYPay API offers programmatic access to various payment services, enabling seamless integration with financial transactions. Using our API, you can:

- Create Payment Links for UPI - Initiate UPI payment links through the Payin – Create Order API to request payments.

- Generate Secure Hashes - Ensure secure transactions with Payin Hash Logic (HMAC-SHA256), which generates a secure hash to validate requests.

- Check Payment Status - Track and monitor the progress of your payments with the Payin – Status Check API.

- Receive Payment Updates in Real-Time - Get real-time payment status updates through the Payin – Webhook.

- Initiate Payouts - Make outbound payments with the Payout – Payment API to facilitate payouts directly.

- Verify Payout Status - Confirm the completion of a payout using the Payout – Status Check API.

- Check Available Balance - Retrieve account balances in real time with the Payout – Balance Check API.

Note: Please use corresponding secret keys according to the API service, like use payin secret key for Payin APIs and use payout secret key for Payout APIs :

1. Payin – Create Order API (UPI payment link generation) (POST)

1. Payin – Create Order API (UPI payment link generation) (POST)

Request

# Here is a curl example

curl --location 'https://pg.bnypay.in:52118/Payment/TransactionDirect' \

--header 'Content-Type: application/x-www-form-urlencoded' \

--data-urlencode 'MERCHANT_ID=U104' \

--data-urlencode 'ORDER_ID=OD123451' \

--data-urlencode 'AMOUNT=100' \

--data-urlencode 'CUST_NAME=test' \

--data-urlencode 'CUST_EMAIL=sample@gmail.com' \

--data-urlencode 'CUST_MOBILE=9876543210' \

--data-urlencode 'REMARK=test txn' \

--data-urlencode 'PAY_MODE=UPI' \

--data-urlencode 'UPI_CHANNEL=INTENT' \

--data-urlencode 'RETURN_URL=NA' \

--data-urlencode 'HASH=d4fe2cc4627d3c2cc646bbf55db31584459e50a8b338256a1fb14f768de7c557'

The table below lists the various request.

| Field | Type | Description |

|---|---|---|

| MERCHANT_ID | String | Your Merchant ID |

| ORDER_ID | String | Unique identifier entered while creating an order |

| AMOUNT | String | Order Amount in INR |

| CUST_NAME | string | Name of the customer |

| CUST_EMAIL | String | Email of the customer |

| CUST_MOBILE | string | Mobile number of the Customer |

| REMARK | string | Remark for the order |

| PAY_MODE | string | Mode of payment, use 'UPI' |

| UPI_CHANNEL | string | Use 'INTENT' |

| RETURN_URL | string | By default use 'NA' |

Response (upi intent in response):

{

"respCode": "0",

"respStatus": "SUCCESS",

"data": {

"ORDER_ID": "OD123451",

"GatewayTID": "1234567918",

"IntentURL": "upi://pay?pa=testmerchant@upi&pn=DemoEnterprises&mc=0000&tr=1234567918&tn=1234567918&am=100&cu=INR",

"Amount": "100",

"Message": "Payment link generated",

"QR_Image": ""

}

}

Response (base64 QR image in response):

{

"respCode": "0",

"respStatus": "SUCCESS",

"data": {

"ORDER_ID": "TESTC1203",

"GatewayTID": "567783271",

"IntentURL": "",

"Amount": "10",

"Message": "QR image generated",

"QR_Image":

"iVBORw0KGgoAAAANSUhEUgAAASwAAAEsCAIAAAD2HxkiAAAAAXNSR0IArs4c6QAAAARnQU1BAACxjwv8YQUAAAAJcEhZcwAADsMAAA7DAcdvqGQAAC1QSURBVHhe7dNRjtzAki3bO/9J9wMM6yMBx3HEYUqR6n5cn7adpKqE+n//83q9fur9I3y9fI3y9fuz9I3y9fuz9I3y9fuz9I3y9fuz9I3y9fuz9I3y9fuz9I3y9fuz9I3y9fuz9I3y9fuz9I3y9fuz9I3y9fuz9I3y9fuz9I3y9fuz9I3y9fuz9I3y9fuzqH+H/+wu8OtJgPuaxSMc8FinSI14RaTBHinTMYyunK6eDOVKkSIN5MP9RXn3F3Y/9BV4daTAf81ikYx6LFOkRr4g0mCNFOuaxldOV08EcKVKkwTyY/yivvuLux/kJggg=="

}

}

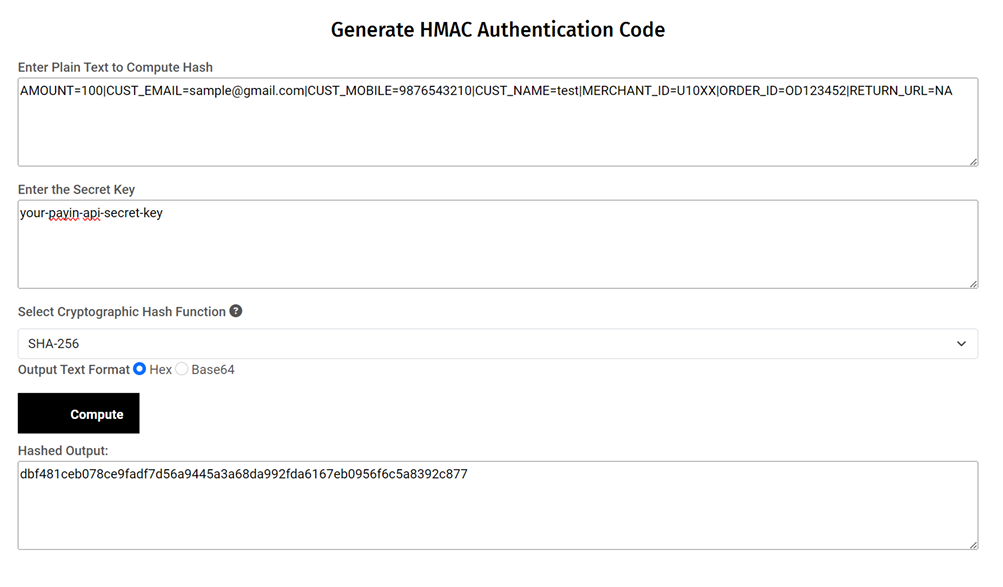

2. Payin Hash Logic (HAMC-SHA256)

Payin hash should include only the below parameters in the given sequence.

Hash input string:

AMOUNT=100|CUST_EMAIL=sample@gmail.com|CUST_MOBILE=9876543210

|CUST_NAME=demo|MERCHANT_ID=U10XXX|ORDER_ID=order123|RETURN_URL=NA

Please verify the generated hash on the link below:

https://www.devglan.com/online-tools/hmac-sha256-online

3. Payin – Status Check API (POST)

3. Payin – Status Check API (POST)

Request

# Here is a curl example

curl --location 'https://status.bnypay.in:52118/api/payin/TransactionStatus' \

--header 'Content-Type: application/json' \

--header 'Authorization: Basic VTEwWFg6YXBpLWtleS1zZWNyZXQtc2hhcmVkLWJ5LWFkbWlu' \

--data '{

"ORDER_ID": "OD123451",

"TxnDate": "2024-07-11"

}'

The table below lists the various request parameters.

| Field | Type | Description |

|---|---|---|

| ORDER_ID | String | Unique identifier entered while creating an order |

| TxnDate | String | Date of transaction in YYYY-DD-MM format |

Response Initiated/Pending:

{

"respCode": "0",

"respStatus": "SUCCESS",

"data": {

"ORDER_ID": "OD123451",

"GatewayTID": "1234567918",

"StatusCode": "2",

"TxnStatus": "INITIATED", // "PENDING"

"Amount": "100.00",

"MDR": "2.00",

"GST": "0.36",

"BankRefNum": "NA",

"Message": "Payment link generated",

"CustomerVPA": "",

"CustomerName": "",

"CustomerMobile": ""

}

}

Response Success:

{

"respCode": "0",

"respStatus": "SUCCESS",

"data": {

"ORDER_ID": "OD123450",

"GatewayTID": "1234567917",

"StatusCode": "0",

"TxnStatus": "SUCCESS",

"Amount": "100.00",

"MDR": "2.00",

"GST": "0.36",

"BankRefNum": "444282073503",

"Message": "Transaction Successful",

"CustomerVPA": "customer.vpa@upi",

"CustomerName": "customer name",

"CustomerMobile": "9876543210"

}

}

Response Failed:

{

"respCode": "0",

"respStatus": "SUCCESS",

"data": {

"ORDER_ID": "OD123451",

"GatewayTID": "1234567918",

"StatusCode": "1",

"TxnStatus": "FAILED",

"Amount": "100.00",

"MDR": "2.00",

"GST": "0.36",

"BankRefNum": "NA",

"Message": "Transaction Failed",

"CustomerVPA": "",

"CustomerName": "",

"CustomerMobile": ""

}

}

4. Payin – Webhook (POST)

4. Payin – Webhook (POST)

# Request:

Content-Type="application/x-www-form-urlencoded"

data={

"ORDER_ID": "OD123451",

"GatewayTID": "100123456",

"StatusCode": "0",

"TxnStatus": "Success",

"Amount": "200.00",

"MDR": "2.40",

"GST": "0.43",

"BankRefNum": "420012362325",

"Message": "transaction successful",

"CustomerVPA": "customer-vpa@upi",

"CustomerName": "",

"CustomerMobile": ""

}&hash=83C88AFCE2B5926AE4D5F5D66A489DF42F8FED6C662DF8ED04438F1234273160

Method Type: POST

When the event is triggered, BNYPay send a HTTP POST request with two parameters data and hash, both in the POST Body. BNYPay POST below 2 attributes-

| Field | DataType | Mandatory | Description |

|---|---|---|---|

| data | JSON | Y | Json transaction data |

| hash | String | Y | Hash calculated using payin api token of the merchant |

HASH Calculation:

Step 1: Concatenate the parameter name and values in alphabetic sequence with “|” between each parameter, as shown below (include only the below param and in the exact sequence):

string strForHash = "Amount=" + data.Amount + "|" + "BankRefNum=" + data.BankRefNum + "|" + "GatewayTID=" + data.GatewayTID + "|" + "GST=" + data.GST + "|" + "MDR=" + data.MDR + "|" + "Message=" + data.Message + "|" + "ORDER_ID=" + data.ORDER_ID + "|" + "StatusCode=" + data.StatusCode + "|" + "TxnStatus=" + data.TxnStatus;

Step 2:Use HMAC function to calculate the hash of strForHash using payin_API_KEY provided to you by BNYPay. The algorithm used should be HMACSHA256.

Step 3: Convert the result to HEX format.

Step 4:Convert the HEX format to uppercase and match with the hash value received in callback response. E.g., if result of step 3 is “feab12cd” then convert it to “FEAB12CD”.

5. Payout – Payment API (POST)

5. Payout – Payment API (POST)

Request

# Here is a curl example

curl --location 'https://api.bnypay.in:52118/api/payout/transaction' \

--header 'Content-Type: application/json' \

--header 'Authorization: Basic VTEwWFg6YXBpLWtleS1zZWNyZXQtc2hhcmVkLWJ5LWFkbWlu' \

--data-raw '{

"ClientTID": "PAY12347",

"Amount": "100",

"AccHolderName": "DEMO",

"BeneficiaryEmail": "test@mail.com",

"BeneficiaryMobile": "9876543210",

"BeneficiaryAddress": "Mumbai",

"Remark": "test",

"AccountNo": "110023456005",

"IFSC": "SBIN0012345",

"TxnMode": "IMPS"

}'

The table below lists the various request parameters.

| Field | Type | Description |

|---|---|---|

| ClientID | String | Your Client ID |

| AMOUNT | String | Transaction Amount in INR |

| AccHolderName | string | Name of the account holder |

| BeneficiaryEmail | String | Email of the beneficiary |

| BeneficiaryMobile | string | Mobile number of the beneficiary |

| BeneficiaryAddress | string | Address of the beneficiary |

| Remark | string | Remark/Comment for the payment |

| AccountNo | string | Account Number |

| IFSC | string | IFSC |

| TxnMode | string | Mode of transaction (IMPS|NEFT|RTGS) |

Response Success:

{

"respCode": "0",

"respStatus": "SUCCESS",

"respMsg": "transaction successful",

"data": {

"ClientTID": "PAY12347",

"GatewayTID": "1003",

"StatusCode": "0",

"TxnStatus": "SUCCESS",

"Transfer_Amount": "100",

"Charge": "5.00",

"GST": "0.90",

"TDS": "0",

"Total_Amount": "105.90",

"BankRefNum": "417051649929",

"Balance": "788.20"

}

}

Response Failed:

{

"respCode": "0",

"respStatus": "SUCCESS",

"respMsg": "transaction failed",

"data": {

"ClientTID": "PAY12348",

"GatewayTID": "1004",

"StatusCode": "1",

"TxnStatus": "FAILED",

"Transfer_Amount": "150",

"Charge": "5.00",

"GST": "0.90",

"TDS": "0",

"Total_Amount": "155.90",

"BankRefNum": "",

"Balance": "788.20"

}

}

6. Payout – Status Check API (POST)

6. Payout – Status Check API (POST)

Request

# Here is a curl example

curl --location 'https://status.bnypay.in:52118/api/payout/TransactionStatus' \

--header 'Content-Type: application/json' \

--header 'Authorization: Basic VTEwWFg6YXBpLWtleS1zZWNyZXQtc2hhcmVkLWJ5LWFkbWlu' \

--data '{

"ClientTID": "PAY12345",

"TxnDate": "2024-07-11"

}'

The table below lists the various request parameters.

| Field | Type | Description |

|---|---|---|

| ORDER_ID | String | Unique identifier entered while creating an order |

| TxnDate | String | Date of transaction in YYYY-DD-MM format |

Response:

{

"respCode": "0",

"respStatus": "SUCCESS",

"respMsg": "Transaction is SUCCESS",

"data": {

"ClientTID": "PAY12345",

"GatewayTID": "1001",

"StatusCode": "0",

"TxnStatus": "SUCCESS",

"Transfer_Amount": "100.00",

"Charge": "5.00",

"GST": "0.90",

"TDS": "0.00",

"Total_Amount": "105.90",

"BankRefNum": "417054697472",

"Balance": ""

}

}

7. Payout – Balance Check API (GET)

7. Payout – Balance Check API (GET)

Request

# Here is a curl example

curl --location 'https://api.bnypay.in:52118/api/payout/balance' \

--header 'Authorization: Basic VTEwWFg6YXBpLWtleS1zZWNyZXQtc2hhcmVkLWJ5LWFkbWlu'

Response:

{

"respCode": "0",

"respStatus": "SUCCESS",

"respMsg": "Balance for the account",

"data": {

"balance": "788.20"

}

}

8. API Response Codes

API Response Code

| respCode | respStatus | Description |

|---|---|---|

| 0 | SUCCESS | API request successful |

| 1 | FAILED | API request failed |

Payin Transaction Status Code

| StatusCode | TxnStatus | Description |

|---|---|---|

| 0 | SUCCESS | Transaction is successful |

| 1 | FAILED | Transaction is failed |

| 2 | PENDING | Transaction is pending, please re-check status after few minutes |

| 3 | EXCEPTION | Transaction status is unknown, please check status again |

| 4 | CHARGEBACK | Transaction has moved to chargeback from success. |

| 5 | REFUNDED | Transaction is refunded back to customer |

Payout Transaction Status Code

| StatusCode | TxnStatus | Description |

|---|---|---|

| 0 | SUCCESS | Transaction is successful |

| 1 | FAILED | Transaction is failed |

| 2 | PENDING | Transaction is pending, please re-check status after few minutes |

| 3 | EXCEPTION | Transaction status is unknown, please check status again. |